Step 1: Decide Your Retirement Age

The most common retirement age is 60 years, but it may vary from person to person.

Some may wish to work beyond 60 years of age, while a few even wish to retire at 55 ––basically, it's a matter of choice.

Estimating your retirement age is an important step because after this age your regular income stream will stop or at least reduce considerably (in case you are eligible for a pension). You will have to depend on your savings and investments to take care of your retirement needs.

This is also the timeframe you are left with to plan for retirement.

For instance, if you are 25 years old and you wish to retire at the age of 50 years, then years to retirement = 50-25=25years.

One of the important factors while deciding your retirement age is the life expectancy rate. In other words, the estimated number of years you are expected to live based on the age, medical condition, family history, and other demographic factors.

An estimated life expectancy as projected by World Life Expectancy is as below:

Age Life Expectancy Age Life Expectancy

5 73.5 55 77.7

10 73.8 60 78.6

15 74.1 65 80.1

20 74.3 70 82

25 74.7 75 84.5

30 75.5 80 87.4

35 75.1 85 90.6

40 75.9 90 94.3

45 76.3 95 98.3

50 76.9 100 102.6

These are indicative figures to give a clue as you plan your retirement. For instance, if you are 30-years-old then you may expect to live up to 75 years. And if you wish to retire at 60 years of age then you need to plan for around 15 years of post-retirement life.

Step 2: Start Early To Retire Peacefully

Like any other goal, start planning your retirement as soon as possible. With several years in hand, you have time and the power of compounding in your favor.

Never delay retirement planning or else you might have to compromise your goal. Worst case you might have to be financially dependent on your children or family. Hence, start early, start now.

Most individuals who are in their 20s and have recently started earning might think that retirement is a distant reality. For them, planning for retirement at this early age may seem like being overly cautious.

However, it is imperative for you to recognize that being young provides you a benefit that is not available to all, 'time'. As it is said, "the early bird gets a bigger pie".

Beginning to invest early in life will enable you to accumulate the necessary corpus required on without much stress. And it gives you peace of mind.

And if you are in your 30s and haven't even started planning for retirement, then it is still not very late. You still have many years to work, earn and save for your golden years. But make sure you do it prudently and differentiate between your needs and wants.

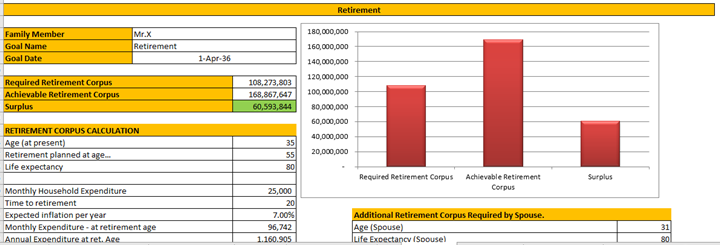

Step 3: Determine Your Retirement CorpusRetirement corpus is the amount you require post-retirement to meet your expenses and continue with the same lifestyle and maybe pursue your other personal goals. For this, first, ascertain your annual expenses at present. For that you need to first write down monthly expenses on various categories such as household, medical, entertainment, travel, EMI, and children's school/tuition fees, and so on. So, it is important that you make an accurate estimate of how much amount you will require, to maintain your present lifestyle after you retire. Then factor in inflation to calculate how much your present expenses will amount to at the time of retirement. This is referred to as the future value of money. This is the amount you will need every year to meet your post-retirement expenses. For instance, Mr. X is 35, wants to retire at 60, currently spends Rs. 75,000 a month on household and other expenses and spends about Rs. 5 lakhs a year on travel and medical. He assumes household inflation is 7% per year both pre and post-retirement, travel, and medical expenses inflate at 10% per year, and he will earn 6% per year on his retirement corpus once it is built and he invests it after his retirement. How much will he need to retire and maintain his current lifestyle? Over Rs. 29 crore. Is this achievable? Yes, it is. Your financial planner can handhold you to set your asset allocation based on your risk profile, select appropriate investment avenues within each asset class, help you manage your cashflows with the needed discipline to invest, and regularly review the portfolio to make sure that you are on track to accomplish this vital financial goal. Alternatively, use PersonalFN's Retirement Calculator to help you with this. Remember, if you like the calculator, share it! Step 4: Calculate The Future Value Of Your Current SavingsHow much you are able to save every year, after meeting all your expenses, plays a crucial role in building your retirement corpus. Your saving is the surplus amount that is left after deducting your annual expenses from your net salary. The ideal way is, to earmark a portion of your savings towards retirement. This part of your saving should be treated as sacred and should not be disturbed unless it is very urgent. After estimating how much amount you will be able to save annually towards your retirement corpus, the next step is to find out its future value. To determine this, you have to factor in the expected rate of return on your investment. This is the value of your savings or investments at the time of retirement. For instance, if you are able to save Rs 100,000 annually for your retirement, and you invest this amount in an avenue, which earns you 10% rate of return p.a., then after 25 years, you will have a retirement corpus of approximately Rs 9,834,706.Step 5: Cut Down On Unnecessary ExpensesIf you are unable to save now to reach the target, cut down on avoidable expenses. Some of the avoidable expenses are your weekly entertainment, impulsive purchases, dining out, foreign vacation, etc. Cutting down on such expenses can help you invest more and reach closer to your targeted corpus.

Step 3: Determine Your Retirement CorpusRetirement corpus is the amount you require post-retirement to meet your expenses and continue with the same lifestyle and maybe pursue your other personal goals. For this, first, ascertain your annual expenses at present. For that you need to first write down monthly expenses on various categories such as household, medical, entertainment, travel, EMI, and children's school/tuition fees, and so on. So, it is important that you make an accurate estimate of how much amount you will require, to maintain your present lifestyle after you retire. Then factor in inflation to calculate how much your present expenses will amount to at the time of retirement. This is referred to as the future value of money. This is the amount you will need every year to meet your post-retirement expenses. For instance, Mr. X is 35, wants to retire at 60, currently spends Rs. 75,000 a month on household and other expenses and spends about Rs. 5 lakhs a year on travel and medical. He assumes household inflation is 7% per year both pre and post-retirement, travel, and medical expenses inflate at 10% per year, and he will earn 6% per year on his retirement corpus once it is built and he invests it after his retirement. How much will he need to retire and maintain his current lifestyle? Over Rs. 29 crore. Is this achievable? Yes, it is. Your financial planner can handhold you to set your asset allocation based on your risk profile, select appropriate investment avenues within each asset class, help you manage your cashflows with the needed discipline to invest, and regularly review the portfolio to make sure that you are on track to accomplish this vital financial goal. Alternatively, use PersonalFN's Retirement Calculator to help you with this. Remember, if you like the calculator, share it! Step 4: Calculate The Future Value Of Your Current SavingsHow much you are able to save every year, after meeting all your expenses, plays a crucial role in building your retirement corpus. Your saving is the surplus amount that is left after deducting your annual expenses from your net salary. The ideal way is, to earmark a portion of your savings towards retirement. This part of your saving should be treated as sacred and should not be disturbed unless it is very urgent. After estimating how much amount you will be able to save annually towards your retirement corpus, the next step is to find out its future value. To determine this, you have to factor in the expected rate of return on your investment. This is the value of your savings or investments at the time of retirement. For instance, if you are able to save Rs 100,000 annually for your retirement, and you invest this amount in an avenue, which earns you 10% rate of return p.a., then after 25 years, you will have a retirement corpus of approximately Rs 9,834,706.Step 5: Cut Down On Unnecessary ExpensesIf you are unable to save now to reach the target, cut down on avoidable expenses. Some of the avoidable expenses are your weekly entertainment, impulsive purchases, dining out, foreign vacation, etc. Cutting down on such expenses can help you invest more and reach closer to your targeted corpus.

Step 6: Plan And Create An Ideal Portfolio Seeking Help Of A Financial Planner

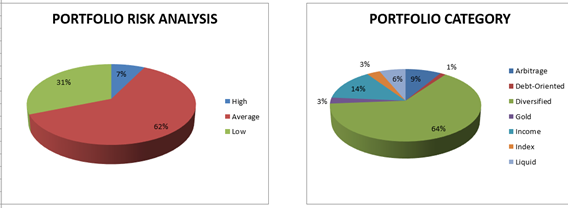

Depending on your current age and the risk that you can afford to take, you should define a standard allocation to each asset class.

It is important to have a diversified investment portfolio across the asset classes.

Some assets like equities have the ability to offer you a better inflation-adjusted return (also known as the real rate of return) than fixed income instrument can provide safety. Gold can be a store of value and act as insurance in your portfolio.

Calculate Real returns using PersonalFN's Real Return Calculator

If you see a swift rally in any of the asset class, and the deviation in your asset allocation, you can timely rebalance by reaping the benefits from the respective asset class and moving it to other asset classes.

Do not forget, every asset class may not be suitable for you. At the same time, you should not be overexposed to a single asset class.

As retirement planning is an exhaustive exercise, seeking help of financial planner can go a long way. But take care to opt for an independent, honest, unbiased, and a competent financial planner who will handhold in every step to plan your retirement.

Your financial planner should be able to come up with a relatively accurate retirement corpus, which can help you negotiate retirement.

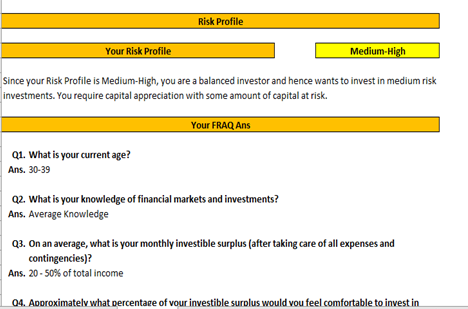

More importantly, he/she should conduct risk profiling, whereby the asset allocation can be set and the portfolio can be structured accordingly to achieve your retirement corpus.

Step 8: Track And Review Your Plan Regularly

Your retirement plan needs to be monitored at regular intervals (at least once a year) to make sure you are on target to meet your objectives. Any changes in the income, expenses, retirement age, etc. needs to be incorporated in the retirement plan.

Also, make sure the retirement plan meets your investment objectives in the changing market scenario.

Retirement planning is the process of determining retirement income goals and the actions and decisions necessary to achieve those goals. Retirement planning includes identifying sources of income, estimating expenses, implementing a savings program, and managing assets and risk.

Get more details here:

Mcx Tips, Derivative-Free Trial, Stock tips

Call on:9977499927

* Investment & Trading in securities market is always subjected to market risks, past performance is not a guarantee of future performance.